The dental industry requires a consistent supply of high-quality instruments, materials, and equipment to maintain optimal patient care standards. Healthcare facilities worldwide face increasing pressure to source reliable dental supplies while managing costs and ensuring regulatory compliance. Establishing partnerships with verified manufacturers has become essential for dental practices, hospitals, and distributors seeking sustainable procurement solutions. The complexity of modern dental supply chains demands strategic approaches that prioritize quality assurance, regulatory compliance, and long-term supplier relationships.

Understanding manufacturer verification processes enables procurement professionals to make informed decisions about supplier selection. Market dynamics continue to evolve as healthcare regulations become more stringent and patient safety requirements intensify. Professional buyers must navigate complex certification requirements while maintaining competitive pricing structures. The dental supply market encompasses thousands of products ranging from basic consumables to sophisticated digital equipment, each requiring specific sourcing strategies and quality control measures.

Essential Criteria for Manufacturer Verification

Regulatory Compliance and Certifications

Verified dental supply manufacturers must demonstrate comprehensive regulatory compliance across multiple jurisdictions. ISO 13485 certification represents the gold standard for medical device quality management systems, ensuring manufacturers maintain consistent production processes and documentation standards. FDA registration and approval status provide critical validation for products entering the United States market, while CE marking indicates European conformity assessment compliance. These certifications require regular audits and continuous improvement programs that validate manufacturing capabilities.

Quality management systems extend beyond basic certifications to include risk management protocols, post-market surveillance programs, and corrective action procedures. Manufacturers should provide transparent documentation of their quality control processes, including statistical process control data and validation studies. Third-party auditing results offer additional verification of manufacturing standards and operational excellence. Professional buyers should request comprehensive certification packages and verify current status through official regulatory databases.

Manufacturing Facility Standards

Physical manufacturing facilities must meet stringent cleanliness and environmental control standards appropriate for medical device production. Cleanroom classifications, environmental monitoring systems, and contamination control procedures directly impact product quality and patient safety outcomes. Modern dental supply manufacturers invest heavily in automated production equipment, climate control systems, and contamination prevention technologies. Facility tours and third-party audits provide valuable insights into operational capabilities and quality commitment levels.

Production capacity assessment helps determine whether manufacturers can meet long-term supply requirements while maintaining quality standards. Scalability considerations become particularly important during market expansion or seasonal demand fluctuations. Backup production capabilities and disaster recovery plans ensure supply continuity during unexpected disruptions. Geographic location factors influence shipping costs, lead times, and regulatory compliance requirements that affect overall procurement strategies.

Effective Supplier Research and Evaluation Methods

Digital Platform Utilization

Professional B2B platforms have revolutionized the dental supply sourcing landscape by providing comprehensive manufacturer databases and verification services. Advanced search filters enable buyers to identify suppliers based on specific product categories, certifications, geographic locations, and production capabilities. Platform-integrated communication tools facilitate direct manufacturer contact while maintaining transaction security and documentation trails. Many platforms offer supplier scorecards and performance metrics that provide valuable insights into reliability and service quality.

Online trade directories and industry associations maintain extensive manufacturer listings with detailed company profiles and product specifications. Digital verification badges and third-party endorsements help identify reputable suppliers with proven track records. Social media platforms and professional networks provide additional channels for researching manufacturer reputations and customer feedback. Virtual trade shows and webinar platforms enable remote supplier discovery and relationship building activities.

Industry Network Leveraging

Professional associations within the dental industry provide valuable networking opportunities and supplier recommendation resources. Experienced procurement professionals often share insights about reliable manufacturers through formal and informal communication channels. Trade publication recommendations and editorial coverage highlight emerging suppliers and industry innovations. Conference attendance enables direct manufacturer meetings and hands-on product evaluations in controlled environments.

Peer networks within healthcare organizations offer practical insights into supplier performance and problem-resolution capabilities. Regional buying groups leverage collective purchasing power while sharing supplier evaluation resources and best practices. Industry consultants and procurement specialists provide objective assessments of manufacturer capabilities and market positioning. These networks often identify emerging suppliers before they become widely known in the broader marketplace.

Product Quality Assessment and Testing Protocols

Sample Evaluation Procedures

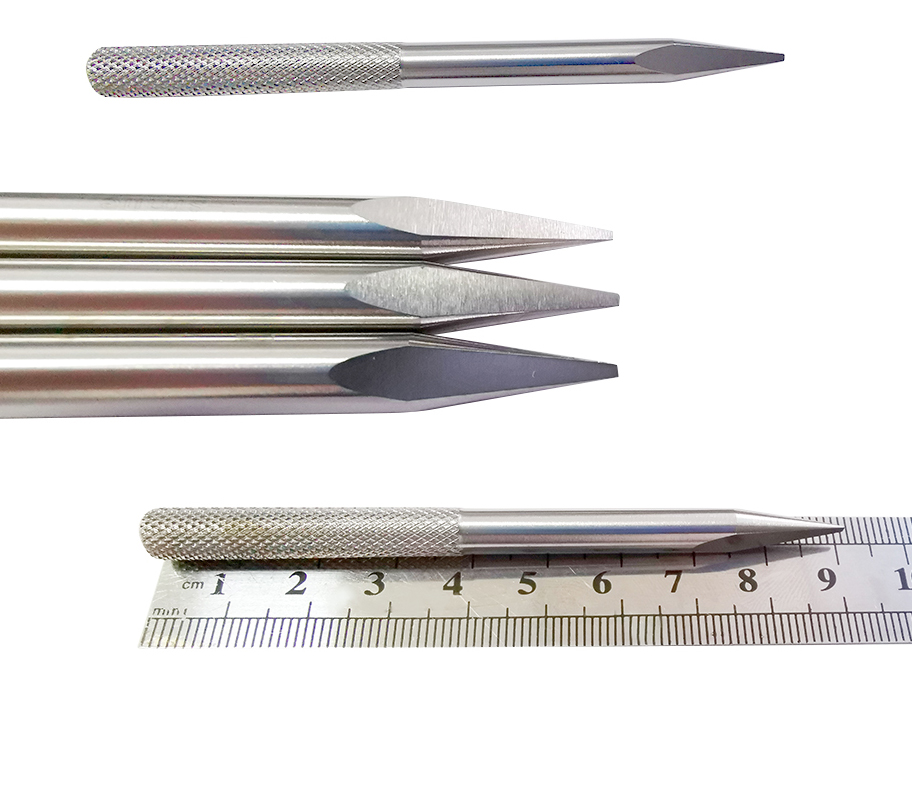

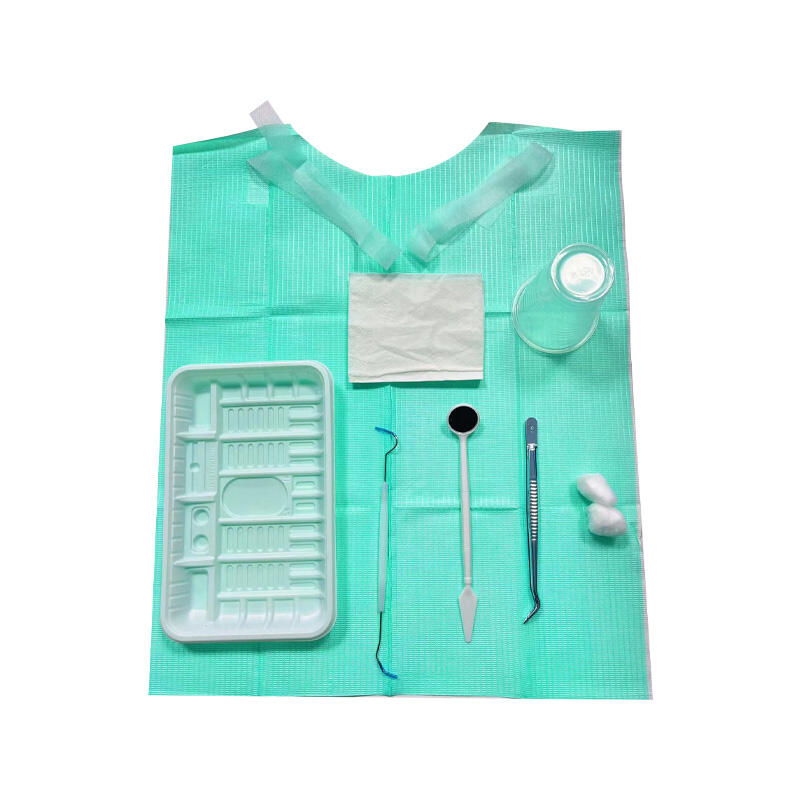

Comprehensive sample testing programs enable thorough evaluation of product quality, performance characteristics, and manufacturing consistency before committing to large-volume purchases. Professional testing protocols should include dimensional accuracy measurements, material composition analysis, and functional performance assessments. Comparative testing against established benchmarks helps identify superior products and potential quality concerns. Documentation of testing results provides valuable reference information for future procurement decisions and supplier negotiations.

Clinical evaluation programs involve practicing dental professionals in product assessment processes to ensure real-world performance meets expectations. User feedback regarding ergonomics, functionality, and patient comfort provides insights beyond technical specifications. Long-term durability testing reveals potential reliability issues that may not appear during initial evaluations. These comprehensive assessment programs reduce procurement risks while ensuring optimal product selection for specific applications.

Quality Control Documentation

Manufacturers should provide comprehensive quality control documentation including certificates of analysis, batch records, and statistical process control data. Traceability systems enable rapid identification and resolution of quality issues while supporting regulatory compliance requirements. Test method validation and calibration records demonstrate measurement accuracy and reliability. Regular quality audits and corrective action documentation provide evidence of continuous improvement commitment and operational excellence.

Material safety data sheets and biocompatibility testing results ensure products meet safety standards for patient contact applications. Shelf life studies and stability testing data support proper storage and inventory management practices. Environmental testing results validate product performance under various storage and transportation conditions. This comprehensive documentation package enables informed decision-making while supporting regulatory compliance obligations.

Building Strategic Supplier Partnerships

Communication and Relationship Management

Effective supplier relationships require consistent communication channels and clearly defined performance expectations. Regular business reviews and performance assessments help identify improvement opportunities while strengthening partnership foundations. Collaborative problem-solving approaches build mutual trust and facilitate rapid resolution of operational challenges. Professional communication protocols ensure information accuracy while maintaining confidentiality requirements for sensitive business information.

Cross-functional team engagement involves technical, quality, and commercial personnel in relationship management activities. Joint improvement projects and innovation initiatives create shared value while advancing mutual business objectives. Cultural understanding and language considerations become particularly important when working with international manufacturers. Investment in relationship management resources typically yields significant returns through improved service levels and preferential treatment during supply shortages.

Contract Development and Risk Management

Comprehensive supplier agreements should address quality standards, delivery requirements, pricing structures, and performance metrics. Risk mitigation clauses protect against supply disruptions, quality issues, and regulatory changes that could impact business operations. Intellectual property protections and confidentiality agreements safeguard proprietary information and competitive advantages. Regular contract reviews ensure continued alignment with changing business requirements and market conditions.

Financial stability assessments help identify potential supplier risks that could impact long-term supply security. Contingency planning and alternative supplier development provide backup options during unexpected disruptions. Insurance requirements and liability coverage protect against potential product defects or performance failures. These comprehensive risk management strategies enable sustainable dental supplies sourcing while minimizing operational vulnerabilities.

Cost Optimization and Negotiation Strategies

Total Cost of Ownership Analysis

Professional procurement requires comprehensive cost analysis that extends beyond initial purchase prices to include transportation, storage, handling, and disposal expenses. Quality-related costs such as returns, replacements, and customer service support significantly impact overall procurement economics. Volume discounting structures and long-term commitment incentives can substantially reduce per-unit costs while ensuring supply security. Currency fluctuation considerations become important when sourcing from international manufacturers with different pricing structures.

Inventory carrying costs and cash flow implications affect overall procurement strategy and supplier selection decisions. Just-in-time delivery programs can reduce storage requirements while maintaining adequate inventory levels. Packaging optimization and bulk shipping arrangements often yield significant cost savings on high-volume products. These comprehensive cost analyses enable accurate supplier comparisons and informed procurement decisions that optimize total value rather than just purchase prices.

Negotiation Techniques and Market Leverage

Effective negotiation strategies leverage market knowledge, competitive intelligence, and volume commitments to secure favorable terms and conditions. Multi-year agreements often provide pricing stability while enabling manufacturers to plan production capacity and raw material procurement. Performance-based incentives and penalty structures align supplier interests with buyer objectives while encouraging continuous improvement. Professional negotiators understand cultural differences and communication styles that influence international business relationships.

Collaborative negotiation approaches focus on creating mutual value rather than adversarial win-lose scenarios. Joint cost reduction initiatives and process improvements benefit both parties while strengthening long-term relationships. Market timing considerations and seasonal patterns influence pricing negotiations and contract timing decisions. These strategic approaches to supplier negotiations typically yield superior results compared to purely transactional purchasing relationships.

FAQ

What certifications should verified dental supply manufacturers possess?

Verified manufacturers should hold ISO 13485 certification for medical device quality management, FDA registration for products entering the US market, and CE marking for European compliance. Additional certifications may include ISO 9001 for general quality management and specific regulatory approvals for specialized products. Third-party auditing results and continuous compliance monitoring provide additional validation of manufacturing standards and operational excellence.

How can buyers verify manufacturer credentials and reputation?

Buyers should request comprehensive documentation packages including certifications, audit reports, and customer references. Professional networks, industry associations, and trade publications provide valuable insights into manufacturer reputations and performance history. Third-party verification services and B2B platforms often maintain detailed supplier profiles with verified credentials and performance ratings. Direct facility visits and customer site references offer additional validation opportunities.

What factors influence dental supply pricing and cost negotiations?

Pricing factors include raw material costs, manufacturing complexity, regulatory compliance expenses, and market competition levels. Volume commitments, contract duration, and payment terms significantly influence pricing negotiations. Geographic location, transportation costs, and currency fluctuations affect international sourcing decisions. Long-term partnerships and collaborative relationships often yield better pricing than transactional purchasing approaches.

How should buyers assess product quality and manufacturing standards?

Comprehensive quality assessment includes sample testing, documentation review, and manufacturing facility evaluation. Clinical evaluation programs involving dental professionals provide real-world performance insights beyond technical specifications. Quality control documentation, certificates of analysis, and statistical process control data demonstrate manufacturing consistency. Third-party testing services and independent quality audits provide objective assessments of product quality and manufacturing capabilities.